Lifestyle Math Professional Development

Explore Your Options

To support the planning and implementation of your Personal Finance or Financial Literacy course, we've developed two professional learning workshops for you and your team.

Get a quick overview in a complimentary 30-minute Introduction to Lifestyle Math or dig into the course with a 3-Hour Lifestyle Math Implementation Workshop designed to build confidence and ensure a successful classroom experience.

Complimentary Webinar

This fast-paced, 30-minute session will help you discover how Lifestyle Math makes personal finance math both relevant and engaging for students.

Explore how this proven program has been expanded and updated to align with state and national standards while delivering real-world money know-how and everyday math practice. You'll also see how the Online Correction Tool provides instant, meaningful feedback—motivating students to strengthen numeracy skills and build confidence in financial concepts.

You'll leave understanding:

- Exactly how Lifestyle Math works in practice

Walk through the student and teacher experience so you can see how this course might fit your setting. - How personal finance concepts are taught through math—not added on

Learn how budgeting, income, and lifestyle decisions are used to reinforce numeracy and real-world math skills. - How Lifestyle Math meets standards

See how the updated program aligns with state and national expectations for personal finance and math instruction. - The powerful role of the Online Correction Tool

Understand how instant, targeted feedback helps students correct mistakes, build confidence, and stay engaged—while reducing grading time for teachers. - What makes implementation easy for instructors

Gain insight into how districts and schools use Lifestyle Math without adding instructional complexity or heavy lift for staff.

Explore Lifestyle Math

If you're looking for a life-changing experience for your students, Lifestyle Math will help you discover how money and math can finally make sense.

Call (800) 967-8016 or click here to request your copy.

- We'll rush you:

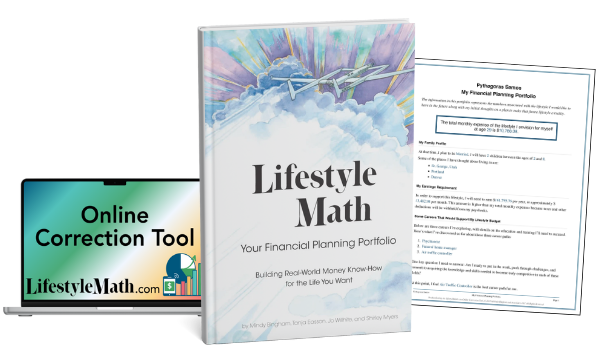

- 240-page Lifestyle Math workbook

- A link to your trial Online Correction Tool account

- A sample Financial Planning Portfolio report

Price per person $129.00 - includes all materials

This 3-hour interactive workshop is designed to help you implement your Personal Finance course with confidence.

Take a hands-on look at teaching financial literacy effectively with Lifestyle Math and the Online Correction Tool. Explore practical, step-by-step tools and strategies that make lessons student-centered, engaging, and easy to teach. Learn how to bring money skills to life so your students are future-ready—prepared for success and financial independence.

Optional facilitated planning time lets you tailor the course for your classroom immediately.

Built on 30 years of proven success—and updated and expanded for today's financial literacy mandates—Lifestyle Math has helped more than 500,000 students master essential money skills.

- How to bring money skills to life through a personalized, real-world budgeting project.

- How to build future-ready students prepared for workplace success and financial independence.

- How to translate sophisticated financial topics into clear, teachable concepts students can grasp, like credit cards, banking, retirement, investing, taxes, and more.

- How to weave in an extra dose of everyday math practice that feels personally relevant and engaging.

- How to strengthen critical thinking and strategic planning skills as a crucial counterbalance in a world that's increasingly reliant on artificial intelligence.

- How to leverage each student's planning portfolio as a powerful tool for counseling, advising, and support.

- A copy of Lifestyle Math: Your Financial Planning Portfolio

- Demo access to the Online Correction Tool

- An optional 30-minute planning session with a curriculum support specialist to customize your course

- Instructors preparing to teach or currently teaching a personal finance course

- Administrators responsible for meeting financial literacy mandates

- School counselors supporting students' financial literacy, future planning, and college/career readiness